Overview

University of Sydney in conjunction with Commonwealth Bank of Australia offered an innovatioin challenge for a indepth research and innovation project to create an integrated system which could act as a survival guide for banks 2040.

Banks are becoming more and more digitalized

and will possibly rendered obsolete in the future. The task therefore is

to see how we can still allow banks to remain relevant in the future and offer services and

products matching the future desires of customers while discussing how the user experience will be woven around these future products.

About Radical Ethical

Radical Ethical is the future of personalized ethical banking powered by mixed reality. We proposed a personalised transperant banking experience in which the customers are allowed to select where they want their money to be invested, experience the work done through mixed reality, gain rewards.

Our Team Radical Ethical won the first prize!

11 groups presented 13 weeks of their research and developments to top executives at CBA.

Timeline: 13 Weeks - 2018

Role: UX Researcher, UX/UI Designer and Digital Designer.

Tools: PoP, Photoshop, Illustrator, Invision, After Effects, Premier Pro

Team: Abhinav Bose, Jingxuan Cao, Roelof Koudenburg, Ingrid Zeilstra

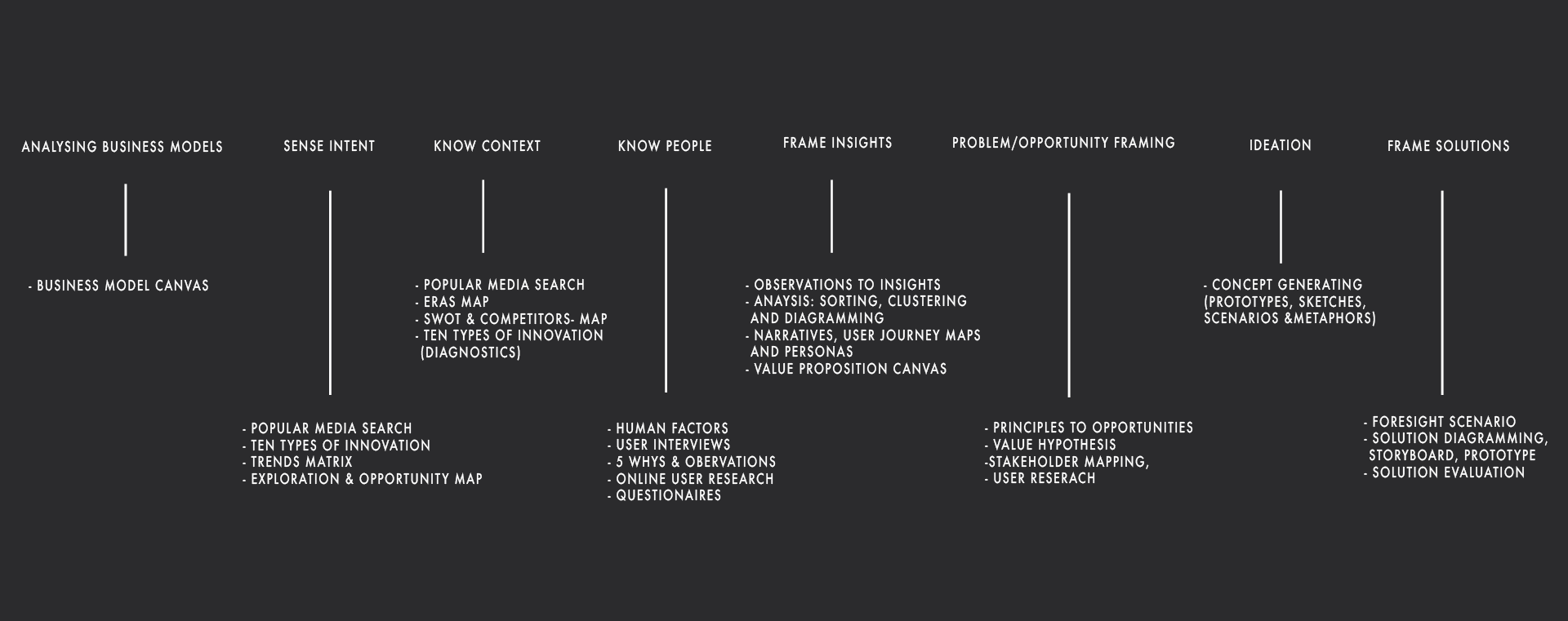

The Brief & Research

The overarching task was to develop a vision for future banking environments (both

digitally and physically) that improve the experience of customers and staff. To achieve this, we

first made attempts to understand the context, define the problem area, and understand the various

stakeholders involved and further design for Innovation.

Our goal was to have a vision broader than product or interactions in

isolation, but rather expanding this vision to include human, business and technology

perspectives and mapping these insights to all aspects of the business and user.

We started by exploring the future of banking through questions such as:

• Banking is a necessity, but are banks?

• What is the role of bank branches in the future?

• The role of mobile branches in emergency situations?

We considered such questions from a range of customer perspectives, such as banking

requirements for an elderly, retired person versus a busy business person on the way to work, and

the social and behavioural implications of these scenarios.

We then researched on how these

changes impacts on existing companies, which currently operate branches of various sizes, in

various locations, attracting various consumers. We explored the impacts of new technology

like mobile payments, P2P-lending and transactions, crowdfunding (loans), big data credit rating,

Cryptocurrencies (Bitcoin), robo-advisors are also impacting the current business of banking.

The Findings

After alot of research our team found the opportunity context around -

Lack of Personalization of banking products :

Highly individualized banking products could fill in an enormous gap in the market and finally align with bank’s highly individualistic customers.

Banks need to become more transparent with regards to their investment portfolio and their social and economic impact on the world. Ethical banking products will be a must in 2040.

Banks need to keep up with the digital distruption:

The banks need to adapt their services and experiences with time and the pace of technologies.

Thus we proposed three unique initial concepts to solve these issues for CBA. Learn more about these concepts in the link below.